Table Of Content

Ohio consistently ranks highly on various “best of” lists, including having a significant number of top-ranked school districts. Offering a mix of large cities and small towns, Indiana provides something for everyone. With a low cost of living, friendly residents, a relatively low crime rate, and four-season weather, the state encourages people to appreciate each season as it unfolds. Almost 3 million people agree with Dorothy – when it comes to Kansas, there’s no place like home. From its cultural offerings, small town communities, tallgrass prairies and, of course, affordability, there’s plenty of reasons people love to call the Sunflower State home.

Complete Data & Rankings for Each State

Property growth data was taken from Redfin.com, and rental growth data was taken from Rent.com. To evaluate states based on recent potential, we ranked each for average monthly rents from the World Population Review, vacancy rates from the U.S. Census Bureau, and the percentage of renters to homeowners from iPropertyManagement. Rankings were derived from states with the highest rents, lowest vacancy rates, and highest percentage of renters to owners.

Top 10 Strongest & Weakest Housing Markets by State

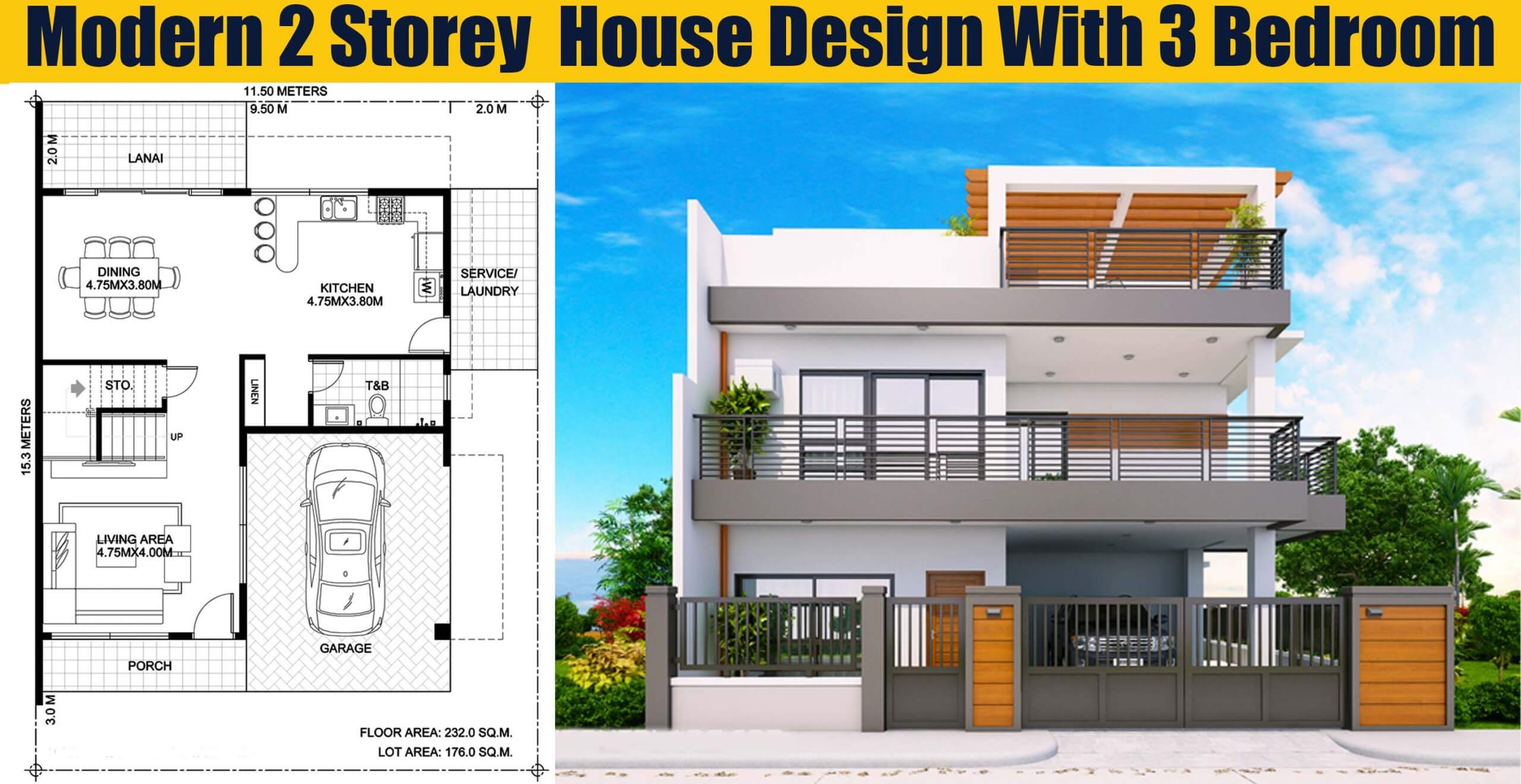

The state boasts the 19th-highest overall location opportunity for residents, which includes job growth, population growth (seventh highest), and happiness score (second highest). These figures show that the state has a lot of employment opportunities and a great living environment, enticing people to relocate. The following table ranks the 10 states with the lowest cost of living and also notes the number of first-time buyer programs, median home sale prices and the 2021–2022 price change (in percent) for each.

New Market

It ranks fifth-highest for its monthly rental income ($1,368), ninth for the lowest vacancy rates, and eighth for the highest percentage of renters (36.7%). These factors make it a top contender for the best states to own rental property and second on our list. Investing in real estate requires you to buy homes in areas that increase equity, have a positive cash flow, and are profitable in the long run.

Cheapest Beach Towns You Can Afford To Live In

Additionally, less than 18% of South Dakota households are housing cost-burdened (13th-best). Home values in the state have increased by 14.38% between late 2021 and 2022, rising to a median $268,094. Kentucky offers a charming blend of Southern hospitality, beautiful countryside, and a rich cultural heritage. Known for its horse racing tradition and bourbon production, the state has a unique charm.

Homeownership in Indiana is relatively attainable for the average household. In 2018, the home value to income ratio was 2.64, the second-lowest in our study. Indiana additionally ranks well for its low property taxes, closing costs and homeowners insurance. The median annual figure paid in property taxes in Indiana is $1,214, the eighth-lowest across all 50 states.

The Hottest U.S. Housing Markets The U.S. News Housing Market Index compares the health of the top 50+ U.S. ... - Real Estate

The Hottest U.S. Housing Markets The U.S. News Housing Market Index compares the health of the top 50+ U.S. ....

Posted: Mon, 12 Feb 2024 08:00:00 GMT [source]

Kentucky: Independence

Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content. Each category was given an equal weight of 20% based on the importance of each metric to the potential for a positive return on investment (ROI). And here are the bottom five states for first-time homebuyers (No. 1 being worst).

Best states for first-time homebuyers

Additionally, Nevada has no state income tax, making it an attractive choice for those seeking financial benefits. With the average home value in the U.S. currently at $346,048, it’s important to consider cost-effective options for homeownership without compromising on quality of life. We have carefully ranked these states from 1 to 10, based on affordability, quality of life, economic opportunities, home value growth estimates, and the Zillow Home Value Index (ZHVI) as of January 2024. This credit card is not just good – it’s so exceptional that our experts use it personally.

The Best Place to Buy a Home in Every State - GOBankingRates

The Best Place to Buy a Home in Every State.

Posted: Fri, 09 Oct 2020 07:00:00 GMT [source]

What Does a Real Estate Agent Do? The Benefits of Hiring an Agent

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Despite its low-ranking public school system, Mississippi has its own appeal. It boasts warm weather, friendly people, delicious food, and a low cost of living. Whether for work, retirement, or family, Mississippi allows individuals to save money each month. North Carolina boasts a desirable combination of natural beauty, a mild climate, and a thriving economy.

Cleveland offers even more affordability with a median sale price of $100,833. Montclair might have one of the highest median listing prices in the study, but it’s still over $100,000 below the same area’s median home values, so it could be a bargain. And if you’re looking in New Jersey, that and a high livability score aren’t the only reason to pick Montclair over Newark as Newark is the city in the greatest danger of a housing crisis. This ranking was based on each state’s job growth, population growth, and happiness score. A growing economy creates jobs, which increases the population as more people are drawn to the state for employment opportunities. This causes a demand for housing and a higher happiness of living that includes events, shopping, and dining options.

Thought it has multiple homebuyer programs open to first-time homebuyers, New Jersey suffers from the highest effective property tax rate in the study. New Jersey also has high foreclosure rates, with one foreclosure for every 855 housing units — equal to a foreclosure rate of 0.117%. Idaho has the ninth-highest median home value, which falls just under $450,000. Homeowners will typically pay just over $1,000 in homeowners insurance annually and an effective property tax rate of 0.49% (both of which rank fifth-lowest study-wide).

These data indicate that residents have a lot of career opportunities and are satisfied with their living environment, encouraging people to relocate to the state. The state ranks 22nd overall for its employment, happiness score, and population growth, displaying a moderately paced upward trend. Furthermore, Georgia has the fifth-highest available home inventory (28,952) and a low tax burden at 8.90% (eighth lowest), encouraging individuals to relocate there. Regarding job growth, population, and happiness score, Georgia ranked 14th, 10th, and 20th, respectively. These elements indicate that renters prefer Georgia because it offers a variety of job prospects and a pleasant living environment, making it the best state to buy rental property. In Kentucky, less than 18% of households are housing cost-burdened (12th-best) and there is less than one foreclosed home for every 10,000 houses (sixth-best).

The average monthly rental income is the 18th lowest in the country ($873), and it has a very low percentage of renters (23.8%), ranking 48th, which doesn’t provide much profitability for investors. Y-o-Y home (9.60%) and rent (3.80%) values were fairly high, ranking seventh and 24th-highest, respectively, so investors might have some potential in Maine. Also, combined with a negative Y-o-Y rent value change of -2.36% (40th), there is a slight opportunity for growth down the line.

This table ranks the 10 cheapest states to buy a house for the first time, ranked by 12-month average median sale price. It also notes the number of programs available to first-time homebuyers, the 2021–2022 percent price change and the cost of living for each. In North Carolina, the median home value is roughly $275,500, which is up 19.63% over a one-year period between 2021 and 2022. For prospective homebuyers, this state has the ninth-lowest closing costs ($2,904, typically making up less than 1.5% of the home’s value). Median annual property taxes are also on the lower side, ranking No. 14 at $1,668.